Unified Account Number (UAN) activation is crucial for seamless management of Employee Provident Fund (EPF) accounts. A UAN is a 12-digit number provided to each employee by the Employees’ Provident Fund Organization (EPFO). This unique identifier allows employees to simplify interactions and transactions related to their EPF accounts. Activating your UAN unlocks several features and benefits that make EPF management straightforward and efficient.

Simplified Account Management

Upon UAN activation, employees can consolidate all their past and present EPF accounts into a single account under a singular UAN. This is particularly beneficial for individuals who have worked with multiple employers over the years. By linking all EPF accounts using the UAN, tracking and managing contributions become hassle-free. A centralized view helps in better understanding and monitoring of one’s retirement savings.

For example, suppose an employee worked in three different companies and accumulated INR 1 lakh, INR 50,000, and INR 75,000, respectively, in EPF over various periods. By UAN activate on the UAN portal, the summed EPF balance of INR 2,25,000 can be viewed and managed under one account, eliminating the need to handle multiple member IDs separately.

Real-time Access to Your EPF Account

One of the significant advantages of activating UAN is the ability to access EPF details in real-time. Employees can log in to the UAN portal to view their EPF balance, check updates on their contributions, and view the passbook. This transparency helps in financial planning and allows employees to make informed decisions about their retirement savings.

For instance, if an employee contributes INR 12,000 monthly to the EPF, they can verify each contribution through the UAN portal. Over the year, contributions amounting to INR 1,44,000 will be visibly recorded, ensuring that both the employer’s and employee’s shares are credited timely and accurately.

Easy Transfer and Withdrawal of Funds

When employees switch jobs, the transfer of EPF funds from one account to another can be seamlessly done using the UAN portal. This avoids the hassle of paperwork and long processing times. Similarly, when an employee wants to withdraw funds due to certain circumstances like retirement, medical emergencies, or unemployment, the UAN portal facilitates prompt processing of these claims.

Consider that an employee needs to withdraw INR 50,000 from their EPF account for a medical emergency. By accessing the UAN portal, the withdrawal request can be submitted online, and the amount can be processed quicker compared to traditional methods.

SMS Alerts and Notifications

Activating your UAN ensures that you receive real-time SMS alerts and notifications regarding your EPF account transactions. This feature enhances security by keeping employees informed about any contribution updates, withdrawals, or transfers, reducing the chances of fraud or discrepancies.

For example, if an employer makes a monthly contribution of INR 10,000 to the EPF account, an immediate SMS alert will inform the employee about this transaction, thereby allowing for instant verification. If any discrepancy is noticed, it can be reported to the concerned authorities promptly.

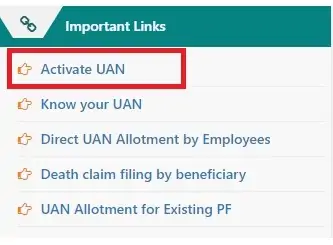

Access to Various Online Services

The UAN portal offers an array of online services that can be incredibly beneficial for employees. These include updating KYC details, downloading UAN Card, tracking claim status, and accessing the pension scheme certificate. Such facilities save time and eliminate the need for physical visits to the EPF office, making EPF account management more convenient.

Suppose an employee needs to update their Aadhaar details linked to the EPF account. By logging into the UAN portal, these changes can be made online, ensuring that all details are up-to-date without any paperwork involved.

Enhanced Security and Control

UAN activation ensures enhanced security and control over EPF accounts. Employees must keep their UAN credentials confidential and change passwords regularly to prevent unauthorized access. The UAN portal’s secure environment makes it a reliable platform for conducting EPF transactions.

Employees can enable two-factor authentication on the UAN portal, adding an extra layer of security to their account. Regularly monitoring account transactions can help in the early detection of any suspicious activities.

Disclaimer:

Investing in the Indian financial market carries inherent risks. Investors must conduct thorough research, consider all guidelines, and be aware of market volatility before making investment decisions. Past performance of investments and sectors may not necessarily indicate future prospects.

Summary: Why Activating Your UAN is Essential for Managing EPF Accounts

Activating your Unified Account Number (UAN) is fundamental for efficient and effective management of Employee Provident Fund (EPF) accounts. A UAN consolidates all past and present EPF accounts, simplifying account management considerably. The UAN portal offers real-time access to your EPF account, enabling better monitoring of contributions and balance. It also facilitates the easy transfer and withdrawal of funds, particularly during job changes or emergencies. Additionally, UAN activation ensures you receive instant SMS alerts for transactions, enhancing security and transparency.

Various online services available on the UAN portal, such as KYC updates, claim status tracking, and download of UAN Card, contribute to the convenience of managing EPF accounts. Security features like two-factor authentication help in safeguarding the account. Activating the UAN provides better control, accessibility, and oversight, making the management of retirement savings a hassle-free experience.

Disclaimer: Investors should evaluate all pros and cons and understand the intricacies of the financial market before making any investment decisions. Past performance does not guarantee future results, and market conditions can be unpredictable.

Discover a wide range of engaging content and insightful articles on **Kurla Day** by visiting. Stay updated with the latest trends, tips, and guides covering various topics that matter to you!